Moving Averages and Statistics for Stock Prices

1. Finding Historical Prices

import requests

In site url, period1 is starting time, period 2 is ending time

site="https://query1.finance.yahoo.com/v7/finance/download/2330.TW?period1=0&period2=1549258857&interval=1d&events=history&crumb=hP2rOschxO0"

response = requests.post(site)

Now historical data of 2330.TW is stored in "response". To check text file:

print(response.text)

To save file as csv

with open('file.csv', 'w') as f:

f.writelines(response.text)

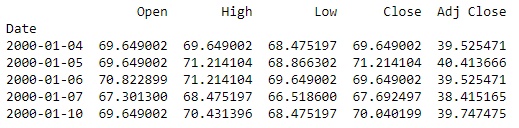

print(df.head())

To improve csv file

- parse_dates changes first column to datetime (instead of 0,1,2,3)

import pandas as pd

df = pd.read_csv('file.csv', index_col='Date', parse_dates=['Date'])

print(df.head())

import numpy as np

import pandas as pd

import pandas_datareader as pdr

import matplotlib.pyplot as plt

%matplotlib inline

Dataframe setting 2019-04-17 as starting date

gld = pdr.get_data_yahoo('GLD', '2019-04-17')

gld.head()

Compute moving averages

gld_close = pd.DataFrame(gld.Close)

gld_close['MA_9'] = gld_close.Close.rolling(9).mean().shift()

gld_close['MA_21'] = gld_close.Close.rolling(21, center=True).mean()

Make sure data doesn't have gaps

gld_close['MA_9'].head(12)

Plotting 9 days and 21 days average of gold prices

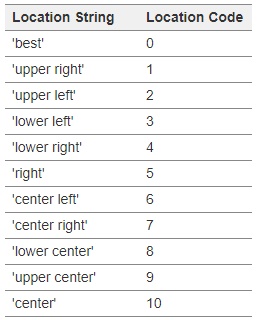

- legend(loc='upper right', shadow=True) determines position of label

plt.figure(figsize=(15,10))

plt.grid(True)

plt.plot(gld_close['Close'], label='GLD')

plt.plot(gld_close['MA_9'], label = 'MA 9 day')

plt.plot(gld_close['MA_21'], label = 'MA 21 day')

plt.legend(loc=2)

Computate historical volatility in options

- Close divided by previous days close

gld_close["change"] = np.log(gld_close["Close"] / gld_close["Close"].shift())

plt.plot(gld_close.change)

Compute using rolling standard deviation., 21 day method

- Average trading days each month is 21

- 21 observations, use volatility from the next day so shift by 1

- Cleaner version of former graph

gld_close['Volatility'] = gld_close.change.rolling(21).std().shift()

gld_close['Volatility'].plot()

- Tips: Special arrows and words: ax.annotate(s="second node", xy=(8,1), xytext=(5,1.5), arrowprops=dict(arrowstyle='->', connectionstyle="arc3, rad=.2"))

- Subplot: fig, ax = plt.subplots()

- axe_base = plt.axes()

- axe_small = plt.axes([0.65, 0.65, 0.2, 0.2]) ----> ([bottom, left, width, height])

2. Basic Stock Price Analysis

Add column expected change as "exp_chng". Closing price multiplied by 1 standard deviation (=21 day rolling sd). Use volatility to predict 1 sd move tomorrow

Add another column actual change as "gld_close". Closing price yesterday minus today

gld_close['exp_chng'] = gld_close['Volatility'] * gld_close['Close'].shift()

gld_close['actual_chng'] = gld_close['Close'] - gld_close['Close'].shift()

gld_close.head()

Slice off rows with NaN data

gld_close = pd.DataFrame(gld_close.iloc[22:])

Magnitude of change

- Actual change/ Expected change. Make column in standard deviations

gld_close['Magnitude'] = gld_close['actual_chng'] / gld_close['exp_chng']

Plot Histogram

- Bins arguments add more columns. Defaults around 10

- Plot against standard deviation

- Likely in negative change than positive side

plt.hist(gld_close['Magnitude'], bins=50)

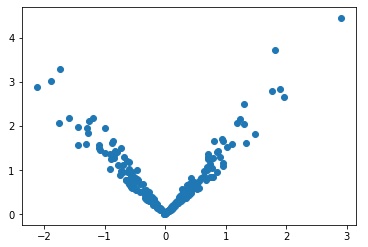

Scatter Plot

Add absolute magitude column

gld_close['abs_magni'] = np.abs(gld_close['Magnitude']

Shows price changes

- x axis in dollars, y axis absolute value in s.d.

- Most around 2.5 s.d. movement

plt.scatter(gld_close['actual_chng'], gld_close['abs_magni'])

3. Correlation Matrix

pip install fix-yahoo-finance

pip install pandas-datareader

Setup environment

import numpy as np

import pandas as pd

import fix_yahoo_finance as fyf

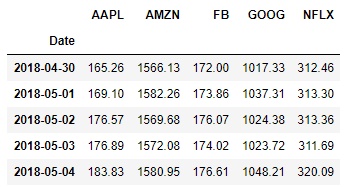

Download data for FANG stocks

- Store downloaded data as "data"

- Automatically sorted name alphabetically

stocks = 'FB AMZN NFLX GOOG AAPL'

stocks = stocks.split()

data = fyf.download(stocks, '2018-05-01')['Close']

data.head()

import matplotlib.pyplot as plt

%matplotlib inline

plt.plot(data)

plt.legend(['AMZN', 'FB', 'GOOG', 'AAPL', 'NFLX'], loc=2)

Transform closing price to rates of return

- Store instanteous data in dataframe called "returns"

- Loop through securities download, ensure not duplicated data

returns = pd.DataFrame()

for stock in data:

if stock not in returns:

returns[stock] = np.log(data[stock]).diff()

returns = returns[1:]

returns.head()

Shows average, min, max, std, 25% etc.

returns.describe()

Shows correlation table

returns.corr()

Display correlation to AMZN in descending order of correlation

returns.corr()['AMZN'].sort_values(ascending=False)

AMZN 1.000000

GOOG 0.768602

NFLX 0.705024

AAPL 0.674327

FB 0.578970

Name: AMZN, dtype: float64

Shows scatter matrix

from pandas.plotting import scatter_matrix

scatter_matrix(returns, figsize=(16,12), alpha=0.3)